Integrating Tax Automation Software

Taxes are a nightmare. They’re complicated, boring, difficult to manage, and expensive to neglect. What’s worse, there appears to be no easy (and legal) way around them. Or… is there?

Thankfully, taxes were annoying and routine enough for developers to get together and digitalize them, creating Tax Automation Software (TAS), which collects, calculates, and files properly prepared tax documents, effectively doing your taxes for you.

Now, if you’re a business, choosing the right TAS can be a bit of a hassle. What features are must-haves? What features are optional? What should you be on the look-out for in your search for the perfect TAS? We too had to face these questions when developing Possio, a European GPS tracking solution. Together with the client, we looked into a number of TAS available on the market, and, having done an extensive research, settled on using Taxamo, as it is a perfect solution for the European market.

However, our choice might not be the one for you, as some TAS can work for your business better that others. Below, we’re comparing four major tax automation services: Taxamo, Taxify, Avalara, and Octobat. You’ll learn about their features, pricing, geographical coverage, possibilities for payment gateway integration, and much more to hopefully assist you in making the right TAS choice for your company!

Tax Automation Software: Standard Features

Most TAS systems offer a standard level of features that include: integrating with your online business (store, website, application — doesn’t really matter what), settling tax amounts from transactions, preparing and filing relevant documents, and storing all of that data for future audits. However, there are differences between them that are most evident in the breadth of services on offer.

Some TAS cover only one country’s tax regulations, while others work across several. Some TAS can integrate with hundreds of payment gateways, while others are able to run only a couple of them. Some have strict, recurring pricing models, while others offer an adaptive pricing structure that works more like a pay-as-you-go service. You get the idea — the main differences between the various tax automation software out there are hidden within the smallest details.

Comparing TAS Features Offered

Taxamo

Tax Calculation

Real-time identification of the most appropriate tax treatment for each transaction, without disrupting customer checkout flow.

Real-time identification of the most appropriate tax treatment for each transaction, without disrupting customer checkout flow.

Tax Collection

Instant collection of Value Added Tax (VAT) and General Sales Tax (GST), directly from payment providers.

Instant collection of Value Added Tax (VAT) and General Sales Tax (GST), directly from payment providers.

Variety of Payments

Supports two types of payments: subscriptions and one-time transactions.

Supports two types of payments: subscriptions and one-time transactions.

International Support

Users are able to choose the countries and regions that they want Taxamo to take VAT and GST liability for.

Users are able to choose the countries and regions that they want Taxamo to take VAT and GST liability for.

Business2Business (B2B) & Business2Consumer (B2C)

Multiple-country compliant B2B support through real-time validation of VAT/business numbers.

Multiple-country compliant B2B support through real-time validation of VAT/business numbers.

Taxify

Real-Time Tax Rates

Accurate, up-to-date tax rates in over 14,000 state/local jurisdictions.

Accurate, up-to-date tax rates in over 14,000 state/local jurisdictions.

Reporting & Audit Trail

Clarity in all tax records, from historical data to current findings.

Clarity in all tax records, from historical data to current findings.

Self-Service Web Portal

An extremely easy-to-use platform, compatible with anyone’s skills.

An extremely easy-to-use platform, compatible with anyone’s skills.

Automated Filing and Remittance

Complete automation of the taxing process, with no stamps, paper, or checks.

Complete automation of the taxing process, with no stamps, paper, or checks.

Print-Ready Tax Forms

Ready-to-sign forms for any state, with accurate, up-to-date tax rates for more than 14,000 US jurisdictions.

Ready-to-sign forms for any state, with accurate, up-to-date tax rates for more than 14,000 US jurisdictions.

Government Certification

Taxify is a member of the Streamlined Sales Tax Project. This future-proofs your business against the changing US federal and state tax laws.

Taxify is a member of the Streamlined Sales Tax Project. This future-proofs your business against the changing US federal and state tax laws.

On-Demand Tax Research

With 20 tax attorneys on staff at all times, Taxify can present their customers with the most current tax rates and rules, enabling them to make smart decisions for the future of their business.

With 20 tax attorneys on staff at all times, Taxify can present their customers with the most current tax rates and rules, enabling them to make smart decisions for the future of their business.

Avalara

Avalara Standard Features

Tax Calculator

Regularly updated, accurate calculation of tax rates for more than 12,000 US jurisdictions.

Regularly updated, accurate calculation of tax rates for more than 12,000 US jurisdictions.

Supports Complex Organizations

Multiple-entity support for every location and/or department of a given organization.

Multiple-entity support for every location and/or department of a given organization.

Product Taxability

Thousands of sales tax rates for each product your business sells, ensuring careful calculation of taxes in every jurisdiction.

Thousands of sales tax rates for each product your business sells, ensuring careful calculation of taxes in every jurisdiction.

Address Validation

Automatic validation and correction of addresses for the highest level house-by-house tax calculation.

Automatic validation and correction of addresses for the highest level house-by-house tax calculation.

Avalara Premium Features

VAT Calculation

Automation of VAT calculations for more than 190 countries.

Automation of VAT calculations for more than 190 countries.

The AvaTax service works with many global businesses, including:

- U.S. companies trading with EU companies or consumers;

- EU companies trading with U.S. companies or consumers;

- EU companies with wholly-owned subsidiaries in the U.S.

AvaTax Exemption

A compliance document management solution for collecting, storing, and managing exemption certificates.

A compliance document management solution for collecting, storing, and managing exemption certificates.

With AvaTax Exemption, users may:

- manage exempt customer information to determine jurisdictional exemption requirements;

- upload and store exemption certificate images, and create or request exemption certificates directly from their customers.

- request new exemptions or update certificates via a standard email template.

provide customers with a mobile-friendly certificate creation wizard using CertExpress.

Additional Integrations

A number of standards certified integrations with more than 650 accounting systems, as well as ERPs, CRMs, and other e-commerce software.

A number of standards certified integrations with more than 650 accounting systems, as well as ERPs, CRMs, and other e-commerce software.

Returns Filing

Automatic preparation of sales tax returns within a single state or across hundreds of jurisdictions. To make sure that everything is calculated and filed properly, tax content is regularly updated to include the latest tax forms and instructions.

Automatic preparation of sales tax returns within a single state or across hundreds of jurisdictions. To make sure that everything is calculated and filed properly, tax content is regularly updated to include the latest tax forms and instructions.

Consumer Use Tax

Simple and affordable solutions for handling use tax accruals for untaxed purchase transactions which are determined to be subject to consumer use tax. With this feature on hand, users can:

Simple and affordable solutions for handling use tax accruals for untaxed purchase transactions which are determined to be subject to consumer use tax. With this feature on hand, users can:

- generate the use tax accruals through a batch upload process; integrate with payable accounts or General Ledger (GL) systems for use tax analysis and calculation;

- integrate with payable accounts or General Ledger (GL) systems for use tax analysis and calculation;

- produce reports that identify the required use tax accruals for filing within state and local jurisdictions.

Landed Cost Calculation

Avalara’s custom duty and import tax calculator provides accurate, real-time calculation of the true cost of cross-border transactions. This feature allows users to:

Avalara’s custom duty and import tax calculator provides accurate, real-time calculation of the true cost of cross-border transactions. This feature allows users to:

- reduce the time spent calculating proper duty rates for the countries you work with; make use of a constantly updated cloud platform that automatically takes care of the ever-changing customs duty and import regulations;

- make use of a constantly updated cloud platform that automatically takes care of the ever-changing customs duty and import regulations;

- seamlessly integrate the API into shopping cart software;

- easily assign tariff codes to every product in your catalog, covering every country you work with.

Octobat

Real-Time VAT/GST/Sales Tax Calculation

Multi-regional tax compliance through accurate identification of international laws applicable to every given online transaction. Taxes can be calculated either at checkout or after the payment has been processed.

Multi-regional tax compliance through accurate identification of international laws applicable to every given online transaction. Taxes can be calculated either at checkout or after the payment has been processed.

Automatic Invoice Delivery

By synchronizing the data from payment providers, Octobat can automatically deliver PDF tax invoices to your customers. These documents are in strict compliance with both local and international laws.

By synchronizing the data from payment providers, Octobat can automatically deliver PDF tax invoices to your customers. These documents are in strict compliance with both local and international laws.

Reports

Octobat’s detailed reports can easily be synchronized with any accounting solution. They include both real-time and consolidated revenue, along with tax calculation splitting.

Octobat’s detailed reports can easily be synchronized with any accounting solution. They include both real-time and consolidated revenue, along with tax calculation splitting.

Audit-Friendly Compliance

Tax settlement reports are generated with automated currency conversion. Every transaction is thoroughly analyzed to identify the applicable governing tax laws (VAT number, billing country, purchase IP address, etc.). This data is then stored for a period of 10 years and can be easily accessed from the application at any time.

Tax settlement reports are generated with automated currency conversion. Every transaction is thoroughly analyzed to identify the applicable governing tax laws (VAT number, billing country, purchase IP address, etc.). This data is then stored for a period of 10 years and can be easily accessed from the application at any time.

Seamless Integration at Checkout

Octobat offers:

Octobat offers:

- an embeddable form which is ready to be integrated with any website/application. This enables users to charge customers at the proper tax rate in just a few minutes (for both subscriptions and one-time payments);

- built-in forms that allow for easy implementation of a customizable tax pricing strategy. These forms include instant tax rate calculation and pricing updates, both of which are based on customer type (end-consumer or VAT-registered business) and location.

TAS Pricing

Taxamo

Taxamo’s pricing structure depends strongly on which of its features you’d like to integrate with your business. Because of that, we recommend contacting their sales team (sales@taxamo.com) to ask for an estimate of the approximate cost for your company’s needs.

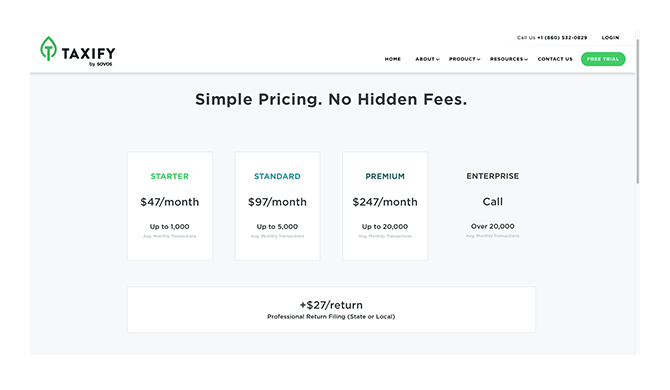

Taxify

Avalara

Offering a wide variety of features and solutions, Avalara’s pricing structure also depends greatly on which features your company needs to use. The best way to determine the cost of Avalara’s TAS is to contact their sales representatives.

Octobat

TAS: The Technical Stuff

For potential TAS customers, the information above should be enough to get a good idea of what tax automation software can do for a business.

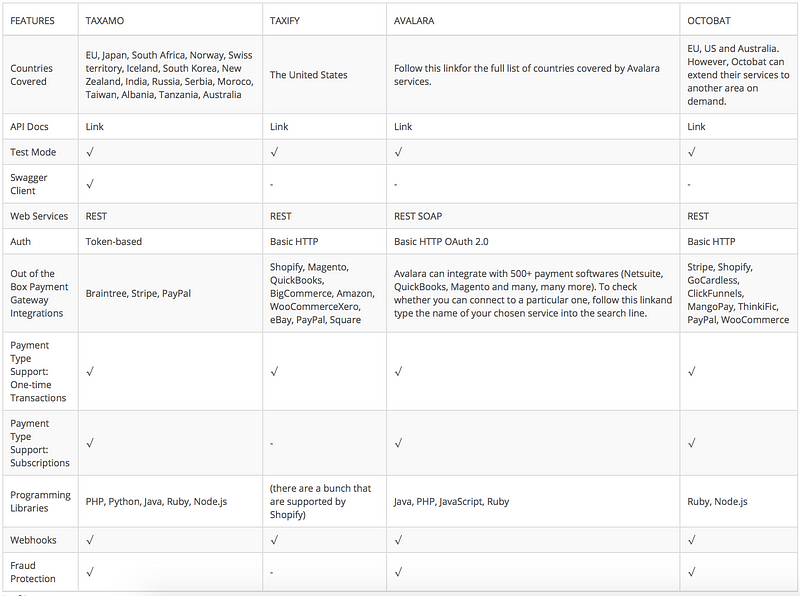

However, for developers looking to integrate TAS solutions for their clients, the technical details are much more relevant. That’s why we’ve asked our own developers here at SteelKiwi to look over the four sets of documentation provided by Taxamo, Taxify, Avalara, and Octobat, respectively, to determine the specifics of integrating these TAS solutions.

Tax Automation Software for Your Business

We hope this post helps you get closer to choosing the right tax automation software for your business! If you need assistance to integrate a TAS into your company’s workflow, please contact our sales team for more information.

0 comments:

Post a Comment